16 Jul 2025

Reminder: Time Is Running Out for Corporate Tax Late Registration Waiver

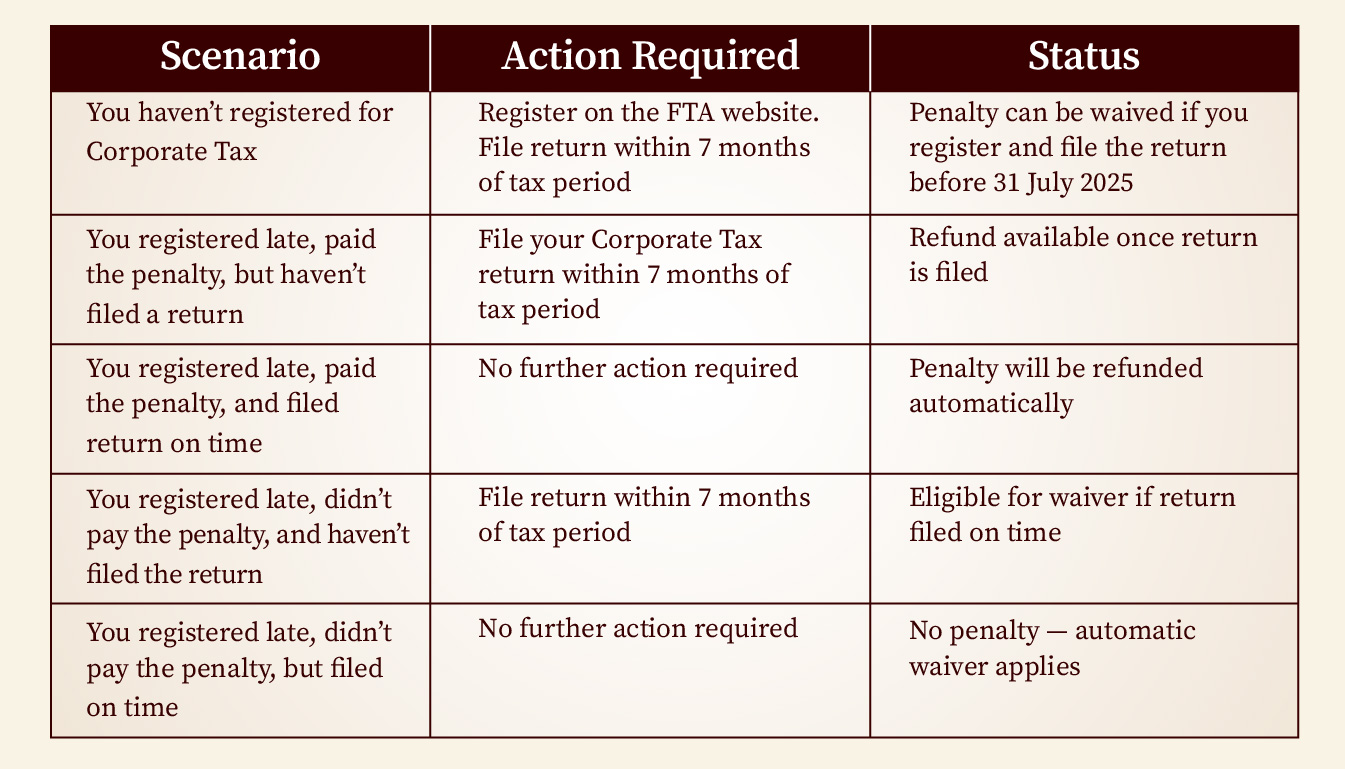

The UAE Ministry of Finance and FTA have introduced a one-time initiative allowing the waiver of Late Corporate Tax Registration, without incurring any financial penalties, provided certain conditions are met

Who Can Benefit?

- Small Businesses & Startups that missed the initial Corporate Tax registration deadline but wish to comply now.

- Individuals earning business income above the threshold who haven’t registered yet.

To qualify for the waiver of the AED 10,000 late registration penalty, a business must:

- Submit their registration application before 31 July 2025.

- Be fully compliant with all other Corporate Tax obligations (including timely filings and payments, if applicable).

Why You Should Act Now:

-

Automatic financial penalties of AED 10,000 will be imposed

-

Future tax filings may face stricter reviews by the FTA

-

Obtaining clearances and approvals could become more complex

Act Fast — Don’t Miss This Opportunity - Take Advantage of This One-Time Relief

Time is of the essence. Avoid unnecessary fines and complications — make sure your business registration is completed before the cut-off. The 31 July 2025 deadline is fast approaching — and there will be no second chances.